An indispensable work tool for treasurers, entrepreneurs, business management consultants

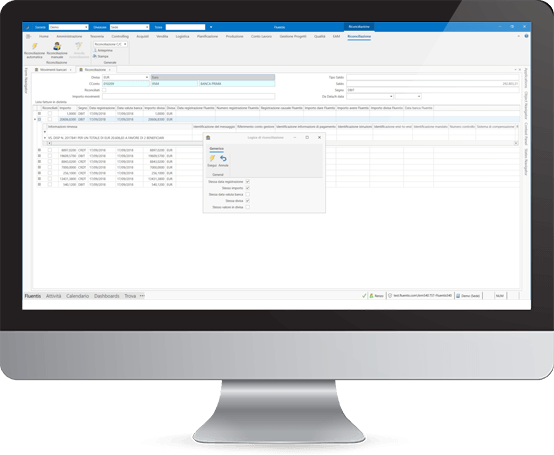

The Fluentis Treasury Management Area is dedicated to the management and verification of outgoing and incoming financial flows, both from the point of view of relations with credit institutions and from the point of view of forecast analyzes and customer risk. Outgoing payment slips are prepared, in the Sepa and Sepa foreign routes, as well as the cash receipts Riba and SDD; incoming you read the unpaid bank file and the bank statement for automatic or manual reconciliation.

In the simulations of the financial flows it is possible to intercept all the management areas, from the active document flow to the liability up to production data, allowing to project the financial analysis beyond the simple accounting data, also channeling them by credit institution and correcting the dates on the statistical forecast of actual collection and payment times recorded in the accounts.

Customer risk allows you to verify both the statistically and operationally the authorization of the active documents of the individual customer or the business group to which they belong, intervening in the document flow of sales through alerts and authorization blocks. There is also the possibility, for those who want more thorough financial management, to connect the main software of the sector, such as DocFinance and Piteco, through already configured flows.

Some features that the Treasury Area provides:

- Plan accounts at infinite levels

- Multi-company and multi-divisional intercompany

- Automatic evaluation of invoices to be received

- Automated management of account closure and reopening and presence of guided procedures for opening accounts and importing balances, assets and items opened by other systems

- Management of open items with accounting/non-accounting schedules

- Customer advance management

- Automatic management and accounting of separate invoices

- Ordinary VAT regimes, 74Ter, agricultural, ventilation of fees, deferred VAT

- Automated management of both solar and mobile plafond

- Registers for declarations of intent both issued and received

- Processing of periodic tax obligations (esterometer, communication of quarterly VAT settlements and electronic certification of withholding tax)

- Automated processing of Intrastat models

- Automatic valorisation of cost centers, profit centers and orders